The Scottish Build to Rent (BTR) sector is continuing to grow. Its membership organisation, the UK Apartments Association (UKAA), has just launched in Scotland, chaired by Gillian McLees, Director of BTR at Rettie & Co. The UKAA has been working on setting up groups across the UK, with a view to helping local BTR markets to develop and grow. Every major UK city now has some level of BTR activity.

The launch event in Glasgow was attended by over 100 people at Shoosmith’s offices in the city centre and featured a range of BTR operators, investors and developers, including Moda Living, Apache and Get Living.

The case for BTR

Scotland, especially Edinburgh and Glasgow, has a shortfall in housing provision, which has translated into rising house prices and rents. On a 5-year basis, the compound annual growth rate of private sector rents is 5% in Glasgow and 4% in Edinburgh. Time to let has also plunged, down from its normal 25-30 days in both cities to around 10 days in the Q4 2021 Citylets quarterly analysis. There is a strong case for BTR considering these market fundamentals.

BTR pipeline

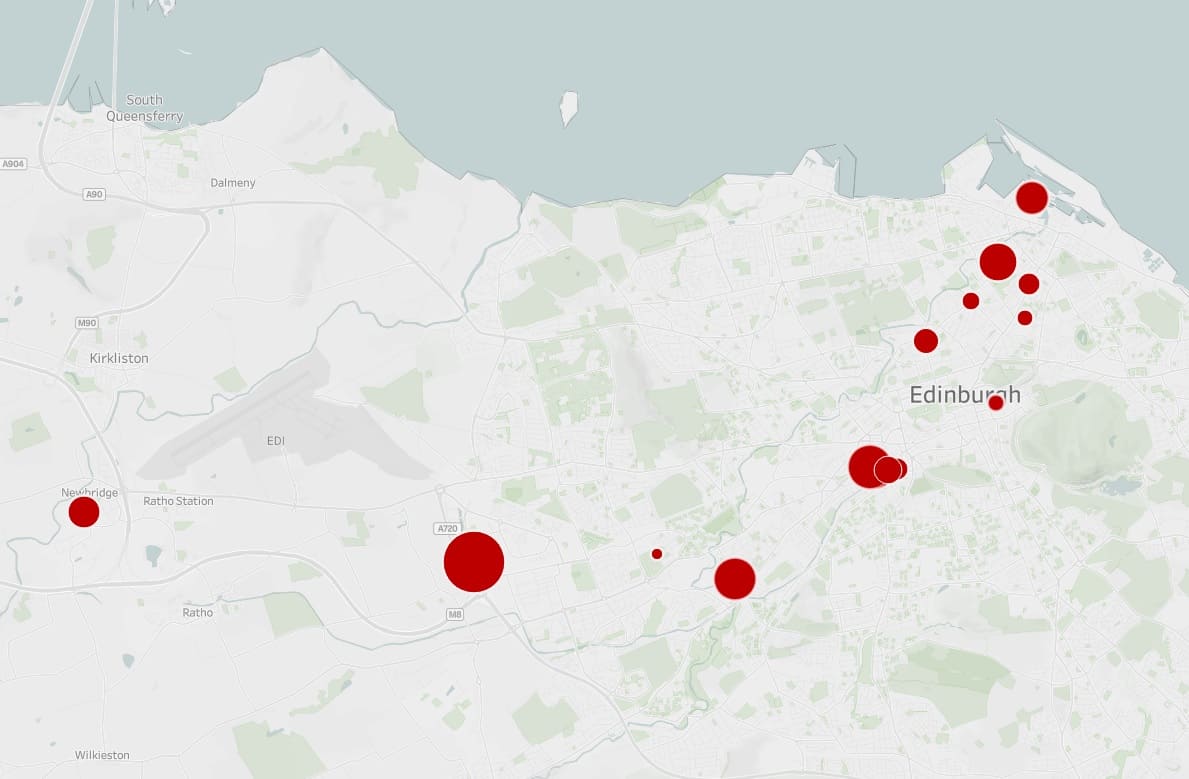

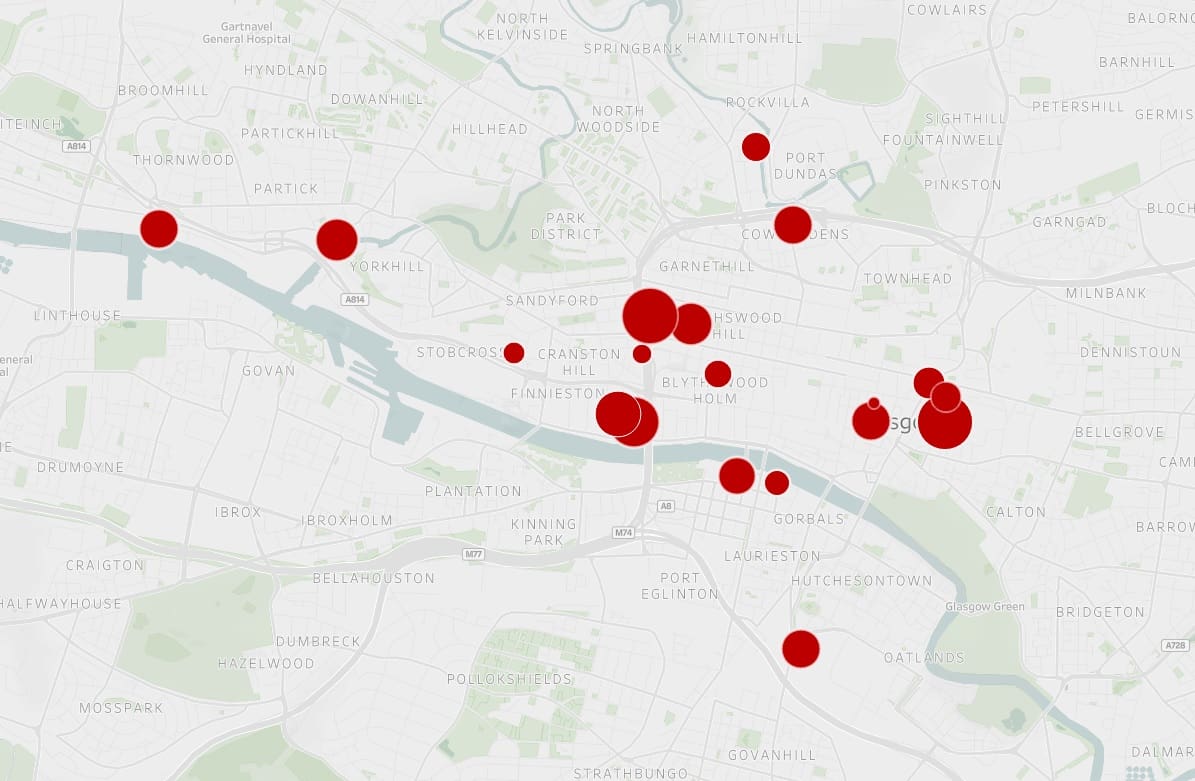

BTR in Scotland has only really emerged as a sector over the past five years, with operational schemes at volume currently concentrated in Aberdeen. In Edinburgh and Glasgow, there is a strong pipeline of stock in planning or under construction (around 10,000 units in total), but to date, only a limited number of units have been made available to the market and are occupied.

BTR PIPELINE

There are currently limited BTR units available to rent in Glasgow, with one boutique development of 36 units at Candleriggs Court operational. While this scheme is technically a BTR scheme, it lacks the scale and amenity usually associated with BTR developments in other cities.

In Edinburgh, Moda has recently launched its McEwan development at Springside in the city’s Fountainbridge area. This development is a prime BTR offering, which delivers the scale and range of amenities expected from BTR, including a cinema room, co-working spaces and a private dining room. While the development has only just been released to the public, the values are targeted at the top 10% of the rental market in the city and have found good levels of demand. Moda Living report that half of the phase 1 units have been let in the first month of marketing.

While Glasgow has a pipeline of over 6,000 BTR units planned, many of these schemes are yet to secure planning, funding or move to construction. This may impact the speed and volume of BTR delivery in the city, despite the comparatively strong pipeline within a Scottish context.

There has been strong Scottish Government support for the BTR sector as well as from councils in Scotland’s main cities, which all see BTR as part of a strategy to build more quickly and to revitalise city centres as places to live and work.

There have been some concerns expressed that BTR is becoming over saturated in places like Glasgow. However, it is also worth noting that even if all the current pipeline was delivered, this level of BTR penetration in the Glasgow PRS sector would still be relatively low compared to other locations in the UK, such as Manchester, which has an established and active BTR sector. If the 6,000 BTR units were all delivered, this would represent 9.4% of the current PRS sector in Glasgow, making it comparable to BTR penetration levels in London but well behind the 18% seen in Manchester. Comparing the pipeline as a percentage of all households, including all tenures, this penetration level drops to under 2%, below levels seen in London and well below the 5.7% seen in Manchester. With similarities in size and economic and demographic structure, this would suggest that Glasgow would have capacity to develop a BTR sector in the same way places such as Manchester or Liverpool have within the English rental market.

BTR additionality

The BTR offering has inherent benefits over the traditional, and often dated, private rented sector (PRS) properties. These benefits allow the BTR sector to achieve rental premiums depending on the offering and value threshold the market can bear.

To give an indicative comparison of value, between PRS and BTR, the base rents being achieved in the market can be supplemented with the additional value being added through BTR services and amenities. For prime locations, services offerings and brands, this can equate to a significant uplift on local rents. However, it is worth noting that, within any market, there will be thresholds above which level demand and affordability will be constrained due to local earnings.

Examples from other UK schemes show that BTR rents can be inflated to 25-50% above city-wide averages based on quality and additional amenity. These rents are still affordable, especially for sharers, although single adults will likely have to be in the top 20% of earners to rent one of these properties.

Political barriers

For BTR and PRS investors, there has been ongoing political uncertainty in Scotland for a number of years to contend with. This does not look like changing anytime soon. There remains strong support in Scotland for another Independence Referendum, which is possible at some point in the next five years, although the outcome is far from a foregone conclusion. The outcomes are even more difficult to foresee should Scotland become independent. It may lead to a different currency (in time) and more markedly different legislation and taxation approaches, but the country would also seek to join European Union and facilitating inward investment will be a key priority. Nevertheless, such uncertainty can often ‘spook’ investors, especially those entering new markets, and a number of major BTR players have decided not to enter Scotland for now because of this.

Due to the new SNP-Greens pact at Holyrood, the PRS in Scotland looks likely to be in for another raft of legislation despite significant reform having taken place just a few years ago. The two parties have formalised some high-level policy commitments.

Much of this will be about trying to reform the weaker end of the traditional PRS and tackling rogue landlords. For the BTR sector, there is probably not a lot to be concerned about, with the exception of a commitment on introduction of rent controls. There is no implementation due until the end of 2025, so that this issue can be looked at very closely over the next few years.

Professor Ken Gibb of Glasgow University and the Collaborative Centre for Housing Research (CaCHE) is undertaking an international study on the use of rent controls, which will inform this. There is also a Cross Party Group at the Scottish Parliament that has been formed to consider the issue involving the industry as well as academics and representatives from tenant unions, charities and the social housing sector. The Scottish Government is looking to build a consensus here.

The sector will therefore have a chance to influence any measures. Looking at ways of mitigation will be important, e.g. a new build (or BTR) exemption may be a possibility, particularly given the amenity spaces that provide additional spaces over and above the residential dwellings; or trying to ensure that rents can be marked back to market on a relet or that a certain level of rent inflation, e.g. CPI +1%, is achievable.

Outlook

As we see BTR blocks now going up around the country, the sector is no longer embryonic or theoretical but part of the housing fabric. The hope is that the success of these initial schemes will encourage others to invest and deliver here and help to create more new homes while revitalising our city centres.